Accounting depreciation calculation service

Does your company have long-term assets that contribute to its activity and enable your business to grow over time? Some of these assets, known as “fixed assets”, generate value over the long term, but also represent costs. In addition, these assets also depreciate as they are used.

In accounting, depreciation is used to spread the acquisition cost of these assets over time. As a result, depreciation expenses lead to a decrease and reduce the value of your assets. This decrease in income allows you to optimize your business fiscally.

Would you like to take advantage of the accounting/tax depreciation of your assets and include it in your financial statement? EB Conseil Fiscal Inc. can provide you with excellent accounting services, allowing you to choose the most advantageous calculation and optimize your taxation.

Your business needs professionals to help you

Depreciation Expense

What is Accounting Depreciation?

In accounting, depreciation represents the loss of value of an asset due to its use over time or to its obsolescence. It is therefore an annual accounting recognition of the loss in value of assets over time. Therefore, depreciation allows the cost of the capital property to be spread over the life of the asset.

The annual depreciation expense of a fixed asset begins when it is placed in service. All property, plant, and equipment are generally depreciable, except land and works of art. The following are considered depreciable tangible assets:

- Industrial machinery and equipment

- Furniture

- General installations

- Buildings

- Transport, office, and computer equipment

Depreciation can also be extended to immaterial assets. It is possible to amortize licenses, patents, software and associated development costs, and websites. Indeed, these evolve and are therefore affected by obsolescence.

Depreciation Expense

Depreciation Expense: Interest and Method of Calculation

As you can see, the benefit of depreciation is that you can see a decrease in the value of the asset and deduct it from your taxes. It analyzes the performance of your possessions and spreads their real cost over time. In this way, you will obtain the exact book value of your assets.

These expenses will be recorded in the balance sheet. An amount corresponding to the depreciation of the asset for the accounting period is then recorded in the income statement.

There are two main ways to calculate accountable depreciation: the straight-line method and the declining balance method. Once you select one of the methods, you must use it in subsequent years for all assets of the same type.

3000

Satisfied customers

45000

Hours of experience

10000000

In tax savings

Straight-line Depreciation

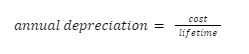

This calculation of depreciation expense consists of recognizing the depreciation of an asset over the years of its use. This method calculates the loss in value of the asset according to its life span. The depreciation will be the same each year, throughout its use. This results in an equal depreciation charge over the life of the asset.

This results in an equal depreciation charge over the life of the asset.

Following the purchase of the asset, the straight-line depreciation calculation allows the company to keep a high profit in the first years. The net book value will therefore decrease over the years, reducing the total amount every year on a straight-line basis.

The straight-line depreciation charge is calculated as follows:

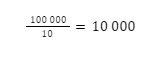

For example, you purchase a piece of equipment for $100,000 in 2019. You estimate that you will use it for 10 years. The depreciation expense you would then be entitled to is $10,000 per year.

For example, you purchase a piece of equipment for $100,000 in 2019. You estimate that you will use it for 10 years. The depreciation expense you would then be entitled to is $10,000 per year.

Declining Balance Depreciation

Compared to straight-line depreciation, this method increases the depreciation expense at the beginning of its useful life.

In declining balance depreciation, a rate is determined. The details of this depreciation method are the same as the ones used in taxation.

Here is how the declining balance depreciation charge is calculated:

![]() Following the same example, you buy equipment for $100,000 in 2019. You estimate that you can use it for 10 years and the loss of its value will be greater in the first years. The decreasing rate that you could use will be 50% according to category 53.

Following the same example, you buy equipment for $100,000 in 2019. You estimate that you can use it for 10 years and the loss of its value will be greater in the first years. The decreasing rate that you could use will be 50% according to category 53.

![]() If we continue the above example, at the end of the year 2019, on the balance sheet for this asset, the net book value will be 100,000 – 5,000 = $95,000. The eligible amortization expense to be recorded in the income statement for the first year will then be $5,000.

If we continue the above example, at the end of the year 2019, on the balance sheet for this asset, the net book value will be 100,000 – 5,000 = $95,000. The eligible amortization expense to be recorded in the income statement for the first year will then be $5,000.

EB Conseil Fiscal

A human company attentive to your needs

20

Years of experience serving you.

Discover us!

Calculate your Expense Depreciation with Experts

Would you like to include the accounting depreciation of your assets in your balance sheet? Our accounting firm in Montreal offers you its services to optimize the management of your finances.

As chartered professional accountants, we can advise you on the most appropriate calculation method for your assets. We will be pleased to assist you in calculating the depreciation expense of your assets.